If you want to leave a robust financial legacy for your family, a financial plan alone is only part of the big picture for your overall monetary health. A well-informed financial plan is worth your time for several reasons, but let’s look at how financial and estate planning can work in tandem to create the best possible future for you and your family.

What’s included in a financial plan

Financial planners analyze an individual’s fiscal landscape and suggest certain approaches to maximize his or her overall financial well-being.

For example, let’s introduce you to Emily. She is an energetic project manager in her late-twenties. She’s found a successful career track after graduating with her bachelor’s and now has an income. Because of this, she often finds herself daydreaming about buying a house with bay windows like the one she passes on her morning commute.

However, before she can take such a big leap, Emily knows she needs financial guidance. She seeks out a skilled financial planner who will take an honest look at her cash flow and her spending and saving habits. From this information, her financial planner will develop, manage and monitor an investment portfolio, which ultimately will allow Emily to feel confident and comfortable with her purchases.

But financial planning only goes so far. To have a comprehensive approach, Emily also must also consider her Estate and the Wills and Trusts she should put in place so her assets go where she wants them. That’s where a Trust and Estate attorney come in.

What’s included in an estate plan

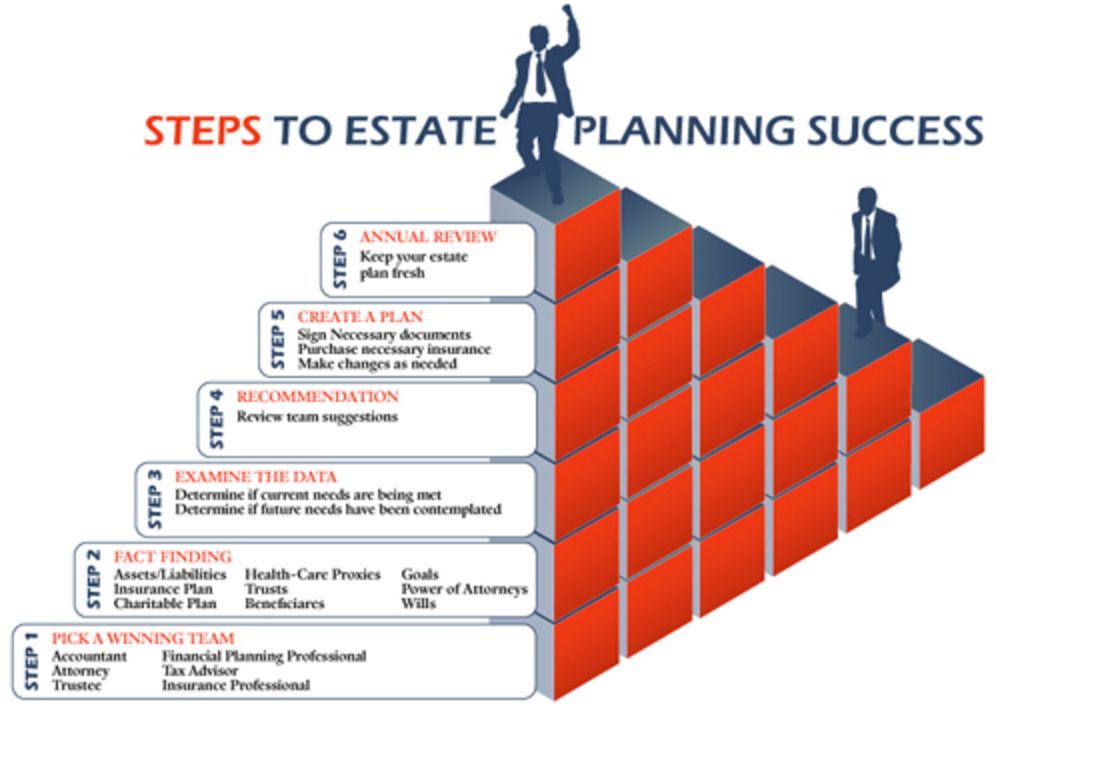

An Estate Planning attorney gives sound advice about what will happen to a person’s assets if he or she becomes incapacitated or dies. While this may not sound like the sunniest of topics, knowing that what you pass on to your family will be legally protected lets you focus on enjoying the best things in life. Estate planning includes defining how you want your loved ones to benefit from your financial legacy, implementing tactics to protect your assets from creditors, providing a framework for medical decisions, developing strategies to help you reduce estate taxes and much more.

At the end of the day, your attorney is a teacher. He or she should be equipped to clearly explain your legal options. Even though estate planning can be highly technical, your professional bond can and should feel like a friendly partnership since it involves taking an honest look at many personal wishes and priorities.

Kerlin Walsh Law specializes in providing Estate Planning with warmth and competence. This means we are friendly, responsive to your questions and needs and understand there is no one-size-fits-all estate plan. We know that if a client is comfortable with our experienced attorneys then they will have a more enjoyable Estate Planning process.

How these two efforts work together

There are several ways these two components of your financial wellness work together. Asking your financial planner and Kerlin Walsh Law to collaborate is common practice. Don’t be concerned that what you’re asking is outside their regular scope of work. Knowing who else advises you will help both parties get the information they need do their jobs effectively.

What are you waiting for?

At the end of the day, you need to be surrounded by a strong team of financial, tax, insurance and estate planning professionals. This will ensure that you give yourself and your family the gift of planning, protection and peace of mind!

If you’re from Oak Lawn, Worth, Chicago, Chicago Ridge, Evergreen Park, Hickory Hills, Palos Hills, Palos Heights, Palos Park, Tinley Park or Orland Park, Kerlin Walsh Law is here to be your go-to Estate Planning resource! We want to work with your Financial Planner and ensure that you take the steps to provide you and your family with financial security. Call 708.448.5169 to schedule your consultation today!