On February 14, 2023, the winner of the largest lottery prize in United States history was named. If you are fortunate enough to have purchased a winning lottery ticket, it is important to carefully consider how you want to handle your unexpected windfall.

Take your time. Lottery winners typically have a specific length of time to claim their winnings, although the deadlines vary by state. You should take time to think carefully about what you would like to do with the cash you have won, preferably even before you claim your prize.

Manage expectations. If your lottery winnings have substantially increased your wealth, you may discover that your popularity has also grown. Do not feel pressured to do anything that you do not genuinely feel good about, and be firm about your choices, regardless of attempts to make you feel obligated or guilty. Nevertheless, you may choose to be generous with your winnings, making gifts to family members, loved ones, or charities. However, keep in mind that large gifts may have tax consequences.

Keep an eye on income tax consequences. You should hold off on buying any private islands, homes, big purchases until all of the taxes on your winnings are paid. After the federal tax payments are made, you will be left with your true winnings. Depending upon the state and city in which lottery winners live, the prize may also be subject to a state tax. It is important to file tax returns reporting your winnings and pay taxes owed to avoid interest and penalties which could be sizeable.

Contact professional advisors. The financial, tax, and legal issues that arise when you win a large prize can be overwhelming if you do not seek help. Before you make any major purchases or gifts, it is important to immediately contact a team of professionals to help you think through how to handle your winnings.

An estate planning attorney, will coordinate with your other advisors, including a financial advisor, a real estate agent (if you are planning to purchase your dream home), an insurance professional, etc. They will help you make decisions and create or update your estate plan to incorporate strategies that will ensure that your winnings are protected during your lifetime, income and transfer taxes are minimized, and that your wealth is distributed to the people you choose in the way you desire when you pass away.

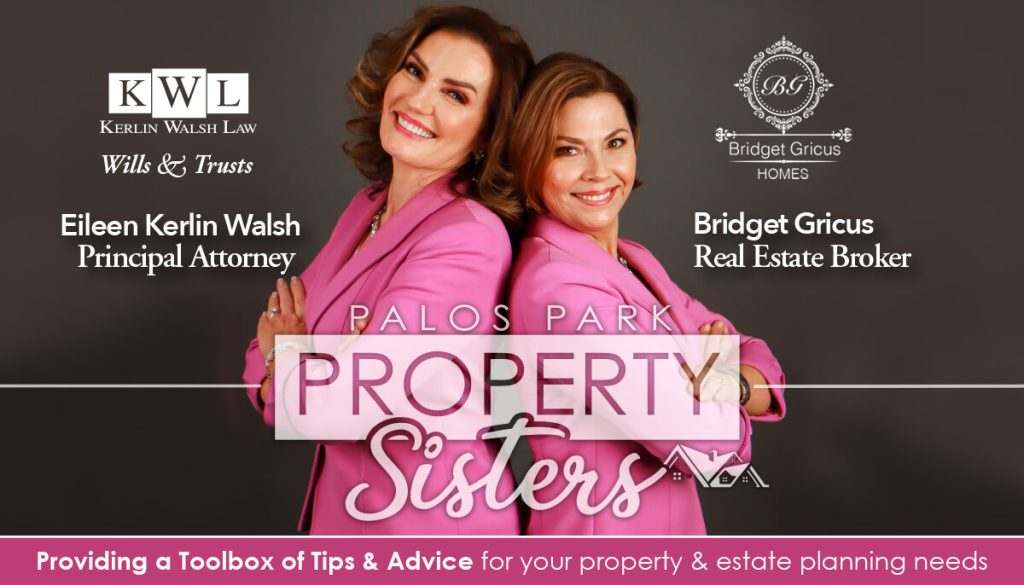

Look for The Property Sisters monthly segment in Stroll Palos Park, or contact:

Bridget Gricus (708) 814-6253, bridgetgricus@gmail.com

Eileen Kerlin Walsh (708) 448-5169, Eileen@KerlinWalshLaw.com