Welcome to Spring Tea with Kerlin Walsh Law. Today I am going to talk about a couple of subjects that I get asked about all the time.

The first is, “What’s the difference between a Will and a Trust?”

Let’s take each document. A Will is a document whereby you determine who gets what you have and whom you put in charge. It’s an important seminal estate planning document and yes, it should be in every estate plan. But here’s the big surprise about a Will. A Will alone does not avoid probate. A Will is based on probate law. It’s a list of instructions for the executor of the Will and the probate court that the Will is going through. It is designed for probate.

Now, you may know someone who had a Will only, who never had to go through probate. That’s probably because the big stuff was taken care of through some other means. An example could be that there were beneficiaries on the account, joint tenants on the home, or maybe payable on death on the bank accounts. The Will was maybe only needed for a little bit of personal property.

However, if the Will is the only plan in the estate, and someone passes away and there is some equity in the home (which many of us have in our portfolio), then that Will will have to go through the probate process. We talked about this a couple of weeks ago. It’s expensive and long winded, public, and can absolutely be avoided with a Trust.

So why are they different?

The Trust is based on Trust law. We have a new, really good update to Trust law in January of 2020. The Trust has its own law. The Trust is its own world. Within the Trust document you name a Trustee and a beneficiary. It’s your little treasure chest for whatever you put in there. For example, if something should happen to the Trustee, if Mom or Dad passes away and they were the beneficiaries of the Trust, then the children now become the beneficiaries. So that Trust exists in its own vacuum. It’s not dependent at all on probate law.

So you really have effectively avoided the whole world of probate by getting a Trust. That’s the difference.

With every estate plan that we do, if the Trust is the basis of it, then we still have what we call a Pour-Over Will. We have to allow for human frailty, for the possibility that something may be outside the Trust at the time of death, and therefore we use that Will to pour anything outside the Trust, in the Trust, so that the Trust provisions will prevail.

That is the main difference between a Will and a Trust.

Trusts also give you so many more choices on what to do with the estate, and how to protect the assets and the beneficiaries. We’ve talked about that in other videos, and we’ll talk about it again.

The main difference again between a Will and Trust is the law that they’re based upon. The difference to you is whether or not you can avoid that costly public court process.

Another question I get asked often is, “We had our estate plan done years ago. We got a Will when our first child was born. Do we need to update it?”

Well, the answer lies with you. You need to ask yourself, “What has changed in that 20-30 years?” Has your family changed? Maybe those little children are grown now. Maybe you named your sisters or brothers or friends to go into that position, and now your children are well able to be your Trustees and Executors and your Powers of Attorney. Have your assets changed? You may very well have done that estate plan when your children were born, you had just bought your home, you were just starting to accumulate your retirement accounts, you didn’t yet have a brokerage…that may all have changed now as the years have passed and you may be getting ready to retire.

What I have seen for most people are three big estate planning stages in their lives. Some people plan more, some plan less, but often I see young couples planning when they first have their children because they’re thinking, “Oh, goodness, what if something happens to us?” They want to make sure that those children are provided for, even if they’re not there. Fast forward 20-30 years, those children bloom, assets are accumulated and the home is paid for. Maybe it’s time to go into a Trust-based plan. Maybe it’s time to get Powers of Attorney in place, because what if we become a little less able.

Fast forward another 20 years, we’re now getting into those later decades. The estate plan truly is no longer about a disaster or “what if”. We now are in a position where we need help with finance, help with healthcare, and maybe there’s a little decline in capacity. And maybe things have changed again in other areas. For a lot of people, three times of estate planning in their lives are going to be enough. Depending on the complexity of their family situation, as people move, as people improve, people move in and out of your life, you may need more or less planning. But you may very need to update your documents. Usually that’s when the law changes, your family changes, your assets change, your relationships change.

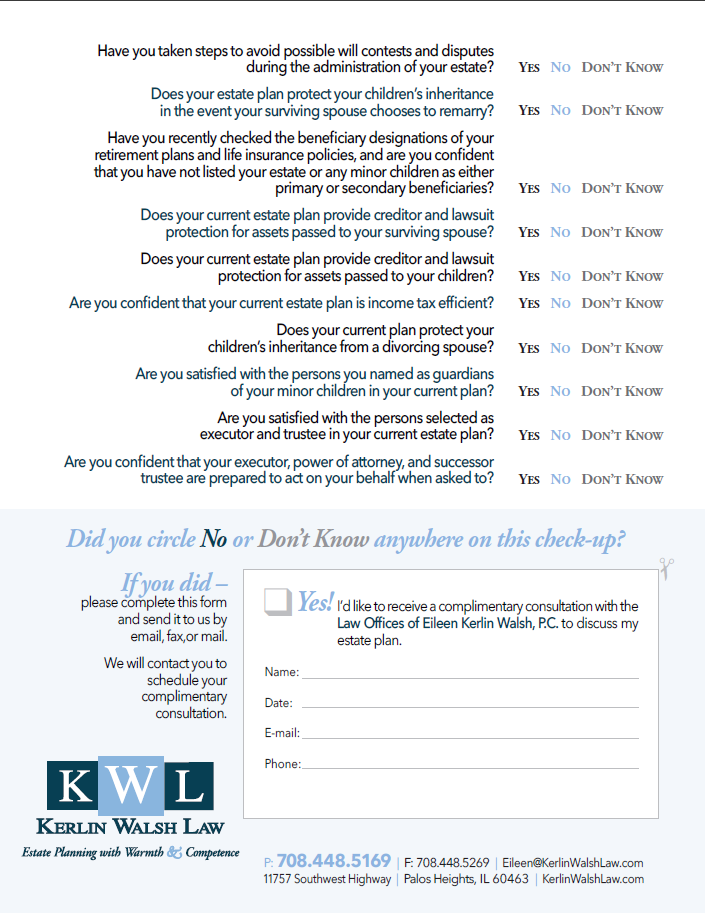

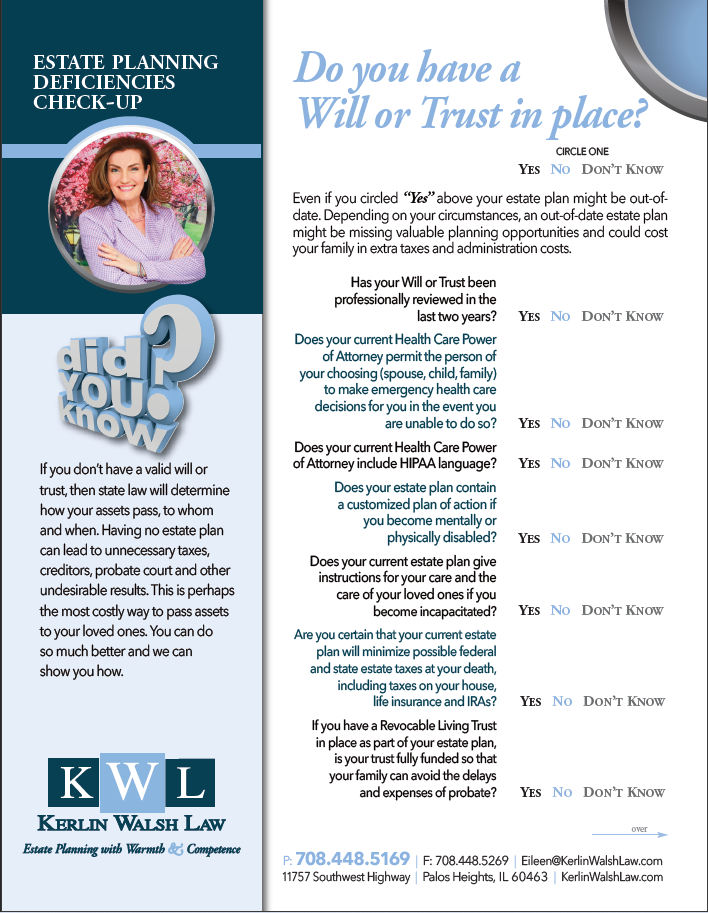

I have for you an Estate Planning Deficiency Checklist. It will go through every single document, every question you need to ask yourself about the law, your assets, your family, and those you have chosen to be in positions of authority. It will help you make that decision as to whether or not you need to update a document you did years ago.

As always, I am here to help if you have any questions. Call 708-448-5169 or send an email to Media@KerlinWalshLaw.com

View the replay of Eileen’s Facebook LIVE video on this topic.

Estate Planning Deficiencies Check-Up – page one

(scroll down for page two)

Estate Planning Deficiencies Check-Up – page two